While diversifying your portfolio is usually wise, it’s possible to take the idea a little too far.

When most U.S. investors talk about the performance of “the market,” they’re usually talking about the S&P 500 (^GSPC -0.69%). And well they should. This index reflects roughly 80% of the U.S. stock market’s total capitalization. If it’s doing well, most investors are also seeing gains from their portfolio. And stocks are still most people’s best bet for capital growth.

There’s (literally) a whole world full of other stocks to consider owning, though. How have they done for investors?

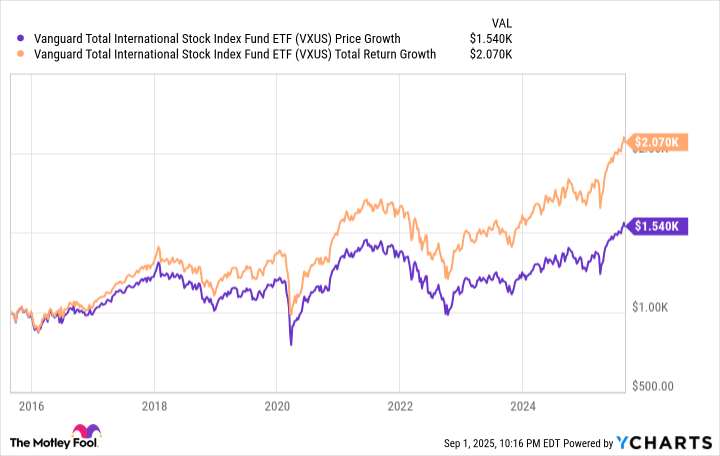

The image tells the tale. A $1,000 investment in the Vanguard Total International Stock Index Fund ETF (VXUS -0.69%) — which mirrors the performance of every one of the planet’s stocks except for U.S. listings — made 10 years ago would be worth $1,540 today. Had you reinvested the dividends it dished out during this 10-year stretch, the figure improves to $2,070.

Data by YCharts.

That’s annualized growth of 4.4%, by the way, or a little more than 7.6% when adding reinvested dividends to the mix.

For the sake of comparison, a $1,000 investment in the SPDR S&P 500 ETF Trust (SPY -0.73%) made at the same time would be worth $3,263 today, or $3,875 if reinvesting the dividends it’s paid between then and now. Those are annualized growth rates of more than 12.5% and 14.5%, respectively.

Not all stocks are the same

This data doesn’t inherently mean U.S. large-cap stocks are unquestionably superior to foreign stocks. The past 10 years have been unusual ones for the entire world, after all. In addition to the stifling COVID-19 pandemic, most of the major technological leaps of late do seem to have been made by American technology companies.

Still, perhaps the Vanguard Total International Stock Index Fund ETF isn’t the ideal option for investors seeking international exposure. It effectively holds exposure to a few thousand stocks representing companies from 47 different countries, many of which you might not want to hold. While indexing is still a sound investment approach, most investors might be better served by being at least a little more strategic … geography-wise.

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard Total International Stock ETF. The Motley Fool has a disclosure policy.

No Comment! Be the first one.