(Bloomberg) — China promised new measures to support the property sector and hinted at greater government borrowing to shore up the economy, as authorities seek to put a floor under the country’s growth slowdown.

Most Read from Bloomberg

Local governments will be allowed to use special bonds to buy unsold homes, Finance Minister Lan Fo’an and his deputies announced at a briefing Saturday, without giving an amount. Lan hinted at room for issuing more sovereign bonds and vowed to relieve the debt burden of local governments, signaling a possible rare revision to the budget that could come in the next few weeks.

“The central government still has quite large room to borrow and increase the deficit,” Lan said, without providing a time frame.

While Lan fell short of putting a price tag on any additional stimulus — potentially disappointing investors — the measures announced were largely in line with economists’ expectations of steps to ease the property sector crisis and debt woes that have forced local governments to tighten their belts. Officials said China will also issue special sovereign notes to boost capital at its largest state-owned banks, a move expected to spur lending to lift the economy.

Vice Premier He Lifeng described the property market as a “weather vane” for the Chinese economy during a visit to several cities in northwestern China this week, the official Xinhua News Agency reported Saturday. He called on officials to “concretely enhance awareness of the political significance” of ensuring housing project delivery and stabilizing the market.

“The announced fiscal supports to mitigate local debt risks, to refill state banks’ capital gap, to give the property sector a helping hand are exactly what the market and investors are expecting,” said Bruce Pang, chief economist for Greater China at Jones Lang LaSalle Inc.

China’s sovereign bonds were seen fluctuating in a small range after the Finance Ministry pledged more stimulus to support the economy but stopped short of giving details. The 10-year government bond yield was indicated little changed at around noon, erasing drops of as much as two basis points, according to traders.

Pang and some other economists expect more details of fiscal stimulus to be published after a meeting of top lawmakers in the coming weeks, including the sale of more treasury debt and a mid-year revision of the budget.

The Standing Committee of the National People’s Congress, the Communist Party-controlled parliament that oversees the government budget, used its meeting last October to approve additional sovereign debt and raise the budget deficit ratio to about 3.8% of gross domestic product.

What Bloomberg Economics Says…

“The most important forward-looking signal is that it will likely provide meaningful funding solutions to help local governments resolve their debt problems. With no immediate new money in sight, central policymakers are likely to focus on supporting local governments to deliver their budgeted spending, while making use of existing resources to stabilize the housing market.”

— Chang Shu, David Qu

Read the full note here.

“The tone is positive — the MOF will likely add new quota of treasury and local bonds,” said Zhaopeng Xing, senior strategist at Australia & New Zealand Banking Group. “We expect 1 trillion yuan of ultra-long treasury and 1 trillion yuan of local bonds to be announced.”

Ahead of the event, investors and economists surveyed by Bloomberg expected the government to commit as much as 2 trillion yuan in new fiscal stimulus.

The Finance Ministry also said the government will expand the sectors eligible to receive funding support from the issuance of special local bonds.

Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Plc., said allowing the use of the bonds for more purposes is “significant” because it could lead to as much as 1 trillion yuan of cash currently idling to trickle through the economy.

“The market may not be paying much attention to the expansion of bond usage as it may not need additional bond quota,” he said. “But I think the briefing slightly beat the expectations of observers who understand how the Chinese government works.”

And while he didn’t give an amount, Lan said the size of the one-off effort to raise the local government limit to swap off-balance sheet debt will be the “largest in recent years.”

Goldman Sachs Group Inc. economists led by Lisheng Wang expect policymakers to enlarge the local government debt swap plan to around 5 trillion yuan for multiple years. This compared to about 1.5 trillion yuan for a similar initiative last year, according to an earlier estimate by UBS AG economist Wang Tao.

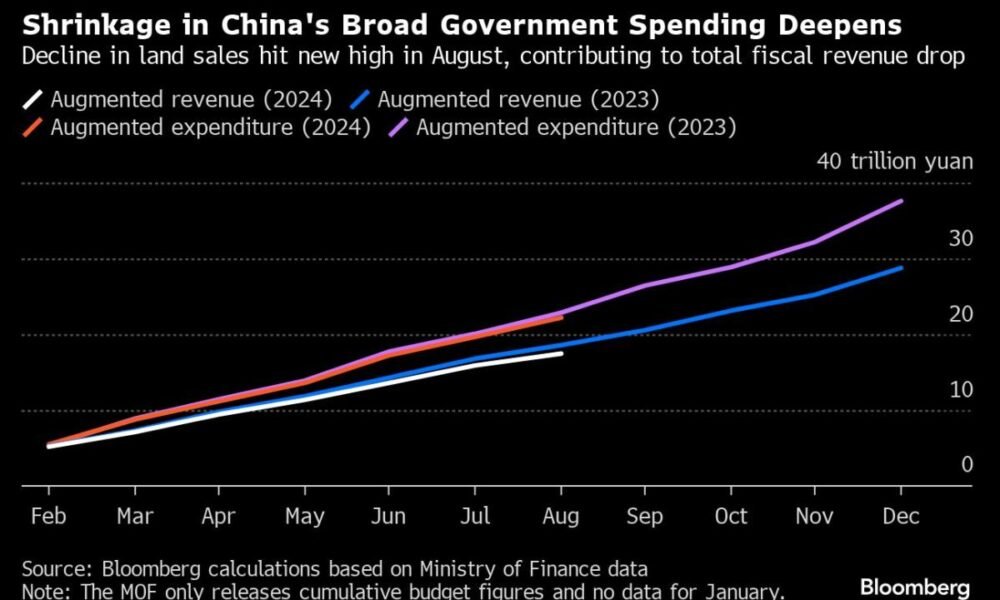

Fiscal support has been the biggest missing piece in a stimulus package Beijing started to deploy in late September, in an unprecedented push led by the central bank that ranged from interest-rate cuts to aid for the property and stock markets.

More expansionary public spending is deemed crucial to reviving the world’s second-largest economy, which is in deflation and risks missing the government’s 2024 growth target of around 5%.

Still, the MOF offered only limited direct boost for consumption at the briefing and no indication of cash handouts to families on a large scale — something Beijing has long resisted due to concerns over what it calls “welfarism.”

“There’s still a long way to go to see the government shifting its stimulus focus to consumption,” said ANZ’s Xing. “Between boosting growth and preventing risks, the government looks to be picking the latter at this stage.”

–With assistance from James Mayger, Wenjin Lv, Ocean Hou, Yujing Liu and Shuiyu Jing.

(Updates with vice premier’s comments in fifth paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

No Comment! Be the first one.