Join Our Telegram channel to stay up to date on breaking news coverage

The current phase of the crypto market presents opportunities for strategic positioning, whether to lock in gains or pursue high-upside plays. As sentiment improves and trading volumes rise, seasoned investors are turning their attention to tokens with compelling fundamentals and technical strength.

This report examines several tokens that have recorded notable gains in the past 24 hours and continue to attract attention due to improving market structures. Any of these assets could be the next cryptocurrency to explode, as they reflect the renewed appetite for alternative coins beyond the dominant large caps, especially in niches like Web3 infrastructure and community-driven innovation.

Next Cryptocurrency to Explode

Among the assets to watch are four high-performing tokens with strong support zones and sustained upside: each displays bullish volume, renewed investor interest, and network activity growth. Alongside them is Best Wallet Token (BEST), a presale asset that has already raised over $13.9 million. Find out more about this presale and the other four potentially lucrative investments below.

1. Flare (FLR)

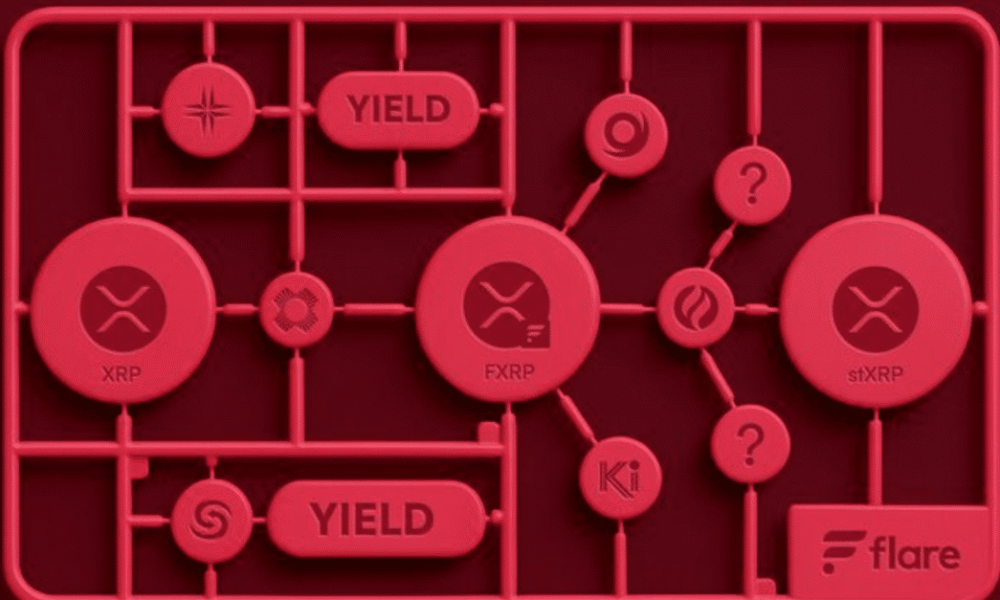

Flare’s increasing utility and expanding ecosystem are central to its bullish case. With over 70% of circulating FLR either staked or delegated, the network benefits from reduced liquid supply and improved security. Core use cases like FAssets v1.1, which require FLR for minting fees and collateral, have made the token integral to the protocol’s design. Daily gas fee burns and a substantial shareholder burn (2.1 billion FLR) add long-term deflationary pressure, while the platform’s unique integration of XRPFi, built exclusively on Flare, highlights its differentiated offering.

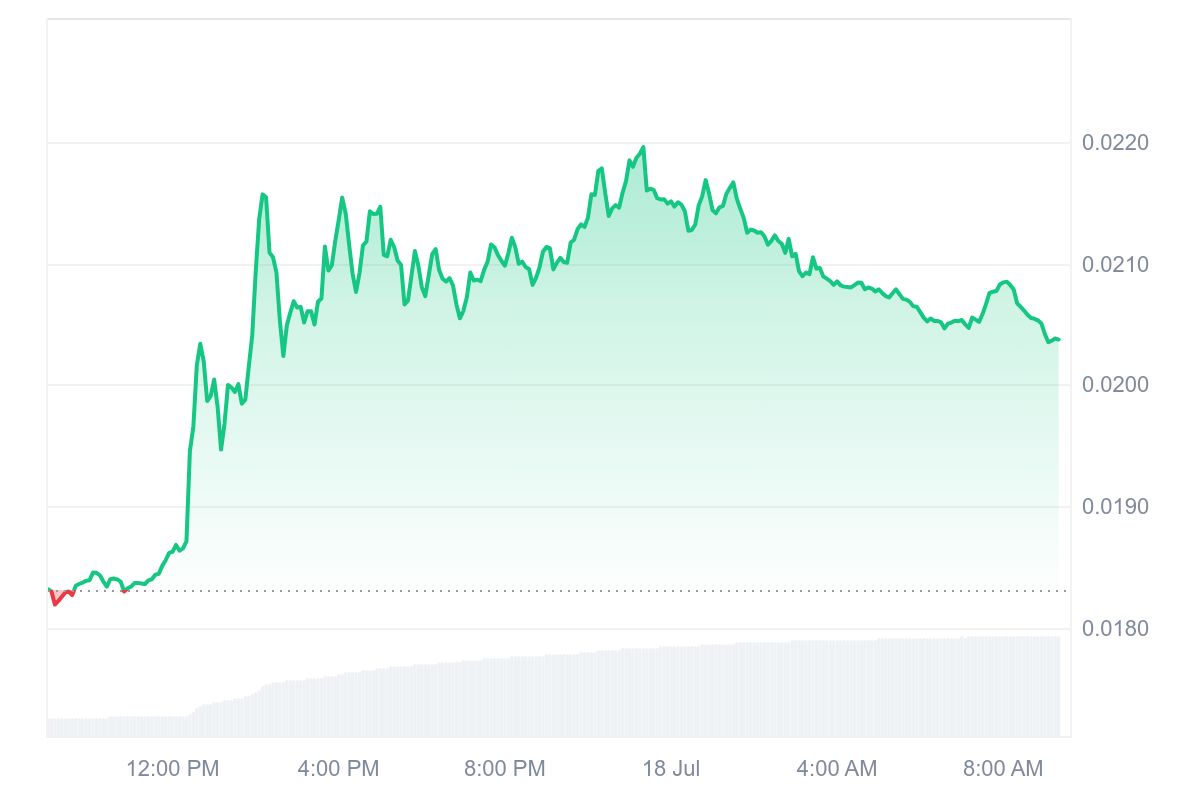

Recent performance metrics support optimism. The MACD shows a bullish crossover, and the RSI reading of 79.14 signals strong momentum despite nearing overbought levels. Price action above key moving averages reflects strength, while Fibonacci retracement levels suggest resistance at $0.02015 and support near $0.0184.

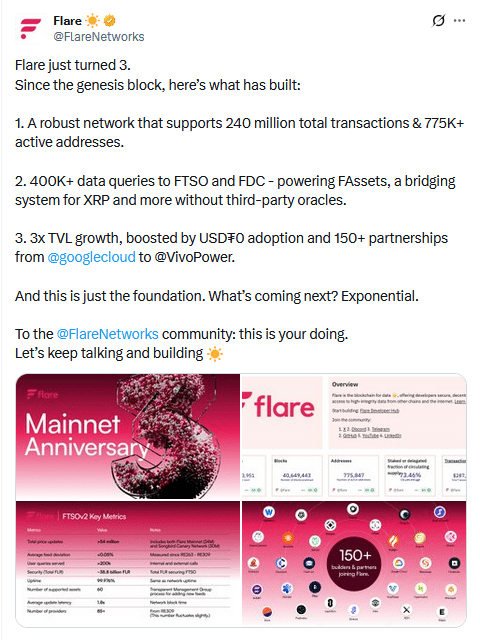

Flare’s third anniversary marked a turning point in its development narrative. Network activity now includes over 240 million transactions, more than 775,000 active addresses, and over 400,000 data queries powering the FTSO and FDC. A 3x increase in TVL, partly due to the adoption of USD₮0 and 150+ partnerships, including with VivoPower and Google Cloud, provides institutional validation. The 2.2 billion FLR incentive program also amplifies token utility.

As Flare pushes toward sustained DeFi expansion and cross-chain infrastructure with XRPFi, its recent 19% weekly price increase could extend if ecosystem growth continues. However, with just 0.036% of total crypto market dominance, FLR is still vulnerable to macro-driven capital rotations. The balance between reduced sell pressure and profit-taking will determine whether it becomes the next cryptocurrency to explode.

2. Tezos (XTZ)

Tezos is gaining attention due to Etherlink, its Layer 2 solution, and recent partnerships focused on institutional-grade DeFi. The Midas collaboration, unveiled on July 16, introduced products like mMEV and mRe7YIELD. These tokenized offerings have already drawn $11 million in TVL, suggesting early traction that could drive sustained demand for XTZ.

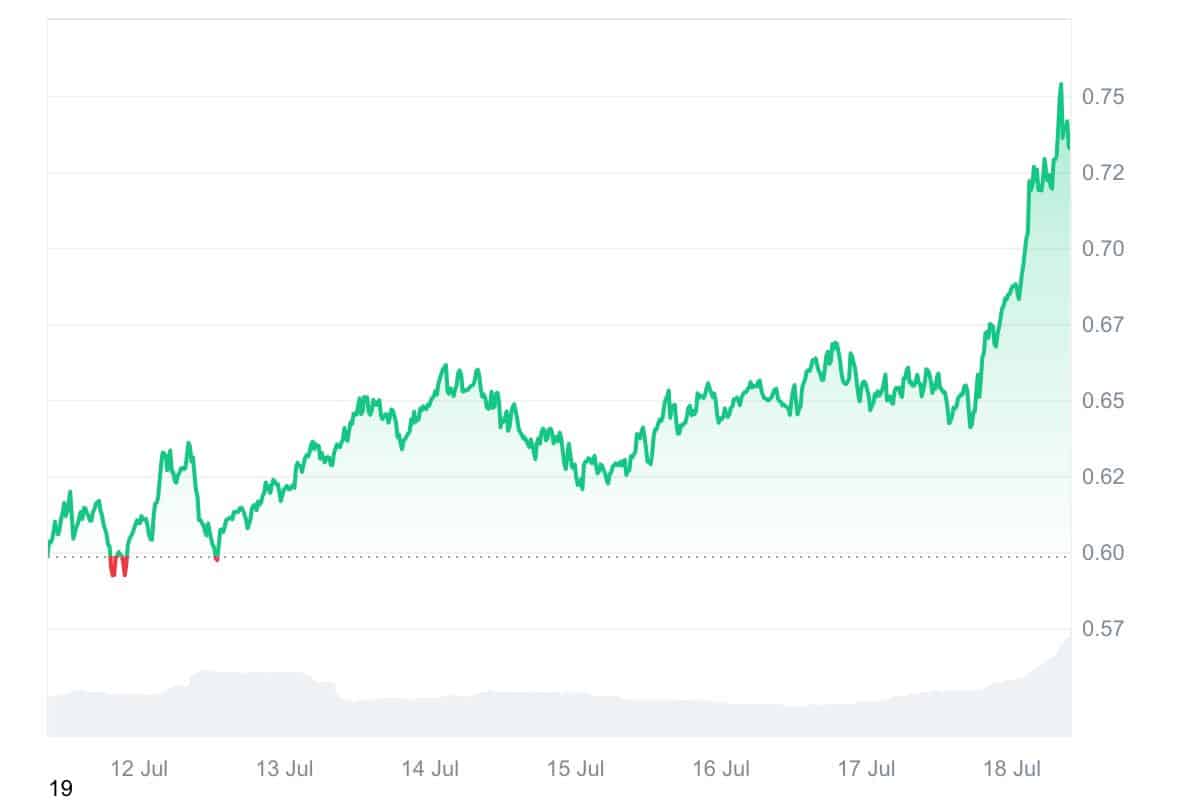

From a technical standpoint, indicators confirm upward momentum. The RSI7 sits at 86.63, clearly overbought, which can attract or repel short-term traders depending on market conditions. The MACD histogram remains positive, and the price trades above the 7-day moving averages. The $0.628 level acted as a Fibonacci-based resistance, and the break above it propelled the token toward $0.732.

What makes Tezos unique is its strategic focus on sustainable DeFi adoption over hype cycles. Etherlink’s transaction volume surged by 6,200% quarter-over-quarter, reinforcing the chain’s growing relevance. Its modular design and governance framework also give it the agility that many competitors lack. Still, relative to dominant Layer 2 ecosystems like Arbitrum and Optimism, Tezos has ground to cover.

Whether XTZ continues to rise depends on Etherlink’s ability to maintain TVL growth and retain developers. A break above $0.80 may target yearly highs, but failure to defend $0.66 could trigger a correction. Its 5–7% staking APY offers passive income, though newer chains occasionally offer higher rates.

3. Best Wallet Token (BEST)

Best Wallet is quickly becoming the go-to Web3 wallet for investors who are just chasing the next pump and building long-term positions in crypto. With over $13.9 million already raised in its ongoing presale, the momentum behind the BEST presale is hard to ignore. And the clock’s ticking fast, with only 6 hours left before the next price increase.

Priced at $0.025345 for now, BEST isn’t just another token. It powers a wallet certified by WalletConnect, packed with deep DeFi integrations and advanced security features like MPC-CMP, the same tech trusted by institutional custodians. But what really sets it apart is its vision.

Upcoming features like automated DCA tools and a staking aggregator promise to make crypto investing simpler, smarter, and more rewarding. And thanks to tools like “Upcoming Tokens,” Best Wallet also helps users spot the next breakout projects before they go viral.

Want to manage Bitcoin long-term or track the next 300% gainer? Best Wallet keeps everything streamlined, with no gas tokens and no hassle. And as more users shift away from hype and toward fundamentals, Best Wallet is positioning itself as the essential tool for modern investors.

Don’t wait until the next round kicks in. Explore the project now and see why so many are jumping in early.

Join the Best Wallet Presale Here

4. Sushi (SUSHI)

SushiSwap remains a key player in the decentralized exchange (DEX) space, though it faces fierce competition. Still, its recent integration with Katana, a Polygon-backed chain, and the rollout of the Katana Rewards Program (400 million KAT tokens distributed) have reinvigorated activity. A reported $100 million in trading volume on Katana within days shows that incentives are succeeding in attracting liquidity.

SUSHI has benefited from the broader 60% growth in Arbitrum’s DeFi sector, of which SUSHI is a part. Technicals point to bullish momentum: the RSI7 is high at 79.85, suggesting a potentially overbought condition, but not yet signaling reversal. The MACD histogram is positive, and price levels near $1.07 indicate a possible Fibonacci target, which aligns with short-term breakout potential.

$100M in volume on sushi on katana.

this volume drives sequencer fees. those sequencer fees go right back into the ecosystem for CoL and more boosted yield. https://t.co/B91svu0yub

— katana ⚔️ (@katana) July 15, 2025

While the DeFi space remains highly competitive, SushiSwap’s continued innovation through partnerships and cross-chain integrations strengthens its relevance. The Katana launch on mainnet, backed by $1 billion in incentives, is an important liquidity event that could continue supporting SUSHI’s price and usage metrics. Meanwhile, Binance’s recent adjustment to margin collateral ratios likely improved the token’s trading appeal.

The challenge for SUSHI is long-term differentiation. Its multichain presence and new incentive models help, but with DEXs evolving fast, product stickiness and liquidity retention are key. If Katana becomes a sustainable liquidity engine, SushiSwap may maintain its spot in the DeFi conversation. Continued engagement and protocol improvements will be crucial in solidifying its breakout potential.

5. Ethereum Classic (ETC)

Ethereum Classic has seen a revival in interest due to renewed exchange listings and protocol development. On July 11, Robinhood and Bitstamp announced global ETC listings, increasing accessibility and liquidity. The next day, media coverage citing ETC as a top bullish crypto further amplified momentum, likely drawing in short-term traders.

Though not due for mainnet deployment until late 2026, the Olympia Upgrade introduces future DAO-based governance and protocol-level funding mechanisms. While speculative at this stage, it signals a shift toward greater developer engagement and long-term value creation. That narrative alone can influence sentiment today.

Technically, ETC is riding strong momentum. RSI levels are elevated across timeframes, pointing to heavy buying pressure. The MACD histogram remains positive, and the token trades above the 200-day EMA, a critical support marker. Fibonacci extensions point to a resistance band near $24.08, which ETC is currently testing at $24.30.

🚨 Draft ECIPs are live for the Olympia Upgrade: Ethereum Classic’s first on-chain treasury & DAO governance system

🔁 EIP-1559 w/ BASEFEE to Treasury

🏛 DAO-controlled funding

📄 Open, permissionless proposalsOpen for review: https://t.co/cf2ncJqoQC https://t.co/7aXCYGGec6 pic.twitter.com/js4hTeGzXU

— Ethereum Classic (@eth_classic) July 5, 2025

Market conditions are also favorable. The Altcoin Season Index has surged 75% week-on-week, indicating risk-on sentiment that benefits older, undervalued Layer 1s. The 200-day EMA providing support means ETC has space to consolidate before its next leg up. The key question remains: can Ethereum Classic build a unique developer community under its new governance model? If so, its risk-reward profile could continue to improve.

Ethereum Classic offers a compelling combination of liquidity expansion and structural upgrades in a crowded smart contract landscape. With increased exchange support and attention from retail investors, ETC might carve out a space in the evolving Layer 1 narrative.

Read More

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

No Comment! Be the first one.